FlouLabs empowers U.S. community and regional banks to expand internationally through a compliance-first infrastructure that connects them with vetted global customers and deposits.

Community and regional banks need new deposits but face increasing regulatory scrutiny. At the same time, millions of professionals and businesses abroad need access to stable U.S. banking.

Existing BaaS models didn’t align business goals, risk appetite, and operational execution—creating gaps in oversight, compliance, and long-term sustainability.

U.S. banks gain compliant access to international deposits through a controlled and transparent onboarding model.

Vetted professionals, entrepreneurs, and businesses abroad gain legitimate access to U.S. accounts and financial services.

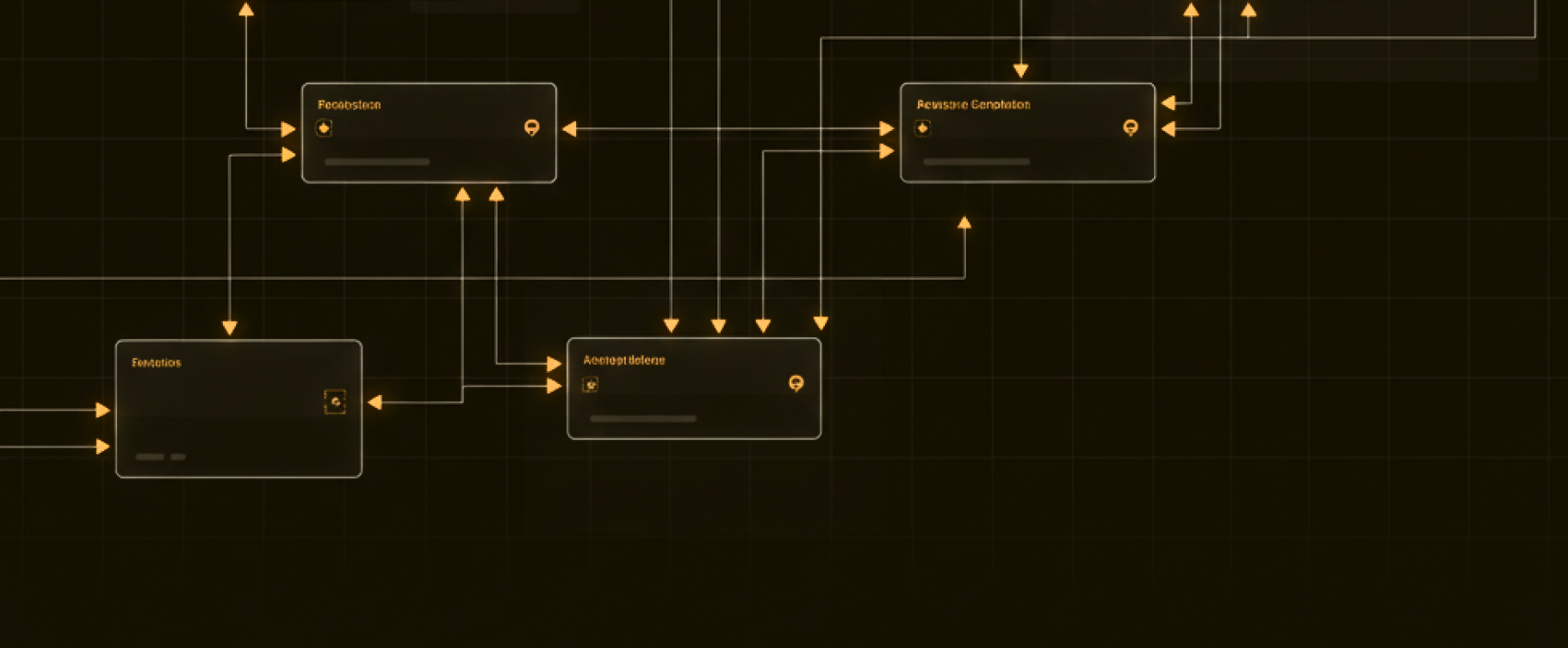

FlouLabs provides a digital branch model that enables banks to acquire and manage international deposits with full regulatory alignment, complete oversight, and no added operational burden.

Platforms can offer users real U.S. banking through a single compliant integration. FlouLabs manages KYC/KYB, AML, and oversight to ensure every program launches aligned and secure.

FlouLabs turns regulatory discipline into operational strength.By ensuring every account and program follows the bank’s own procedures, we reduce risk, build trust, and create a safer path for community banks to serve global customers

Whether you’re a bank looking to expand your reach or a platform serving global users, FlouLabs provides the infrastructure that lets you grow safely.