FlouLabs empowers U.S. community and regional banks to expand internationally through a compliance-first infrastructure that connects them with vetted global customers and deposits.

Partner With Us

Community and regional banks need new deposits but face increasing regulatory scrutiny. At the same time, millions of professionals and businesses abroad need access to stable U.S. banking.

Existing BaaS models didn’t align business goals, risk appetite, and operational execution—leaving gaps in oversight, compliance, and long-term sustainability.

FlouLabs helps U.S. banks embed their services into global value chains and digital ecosystems.

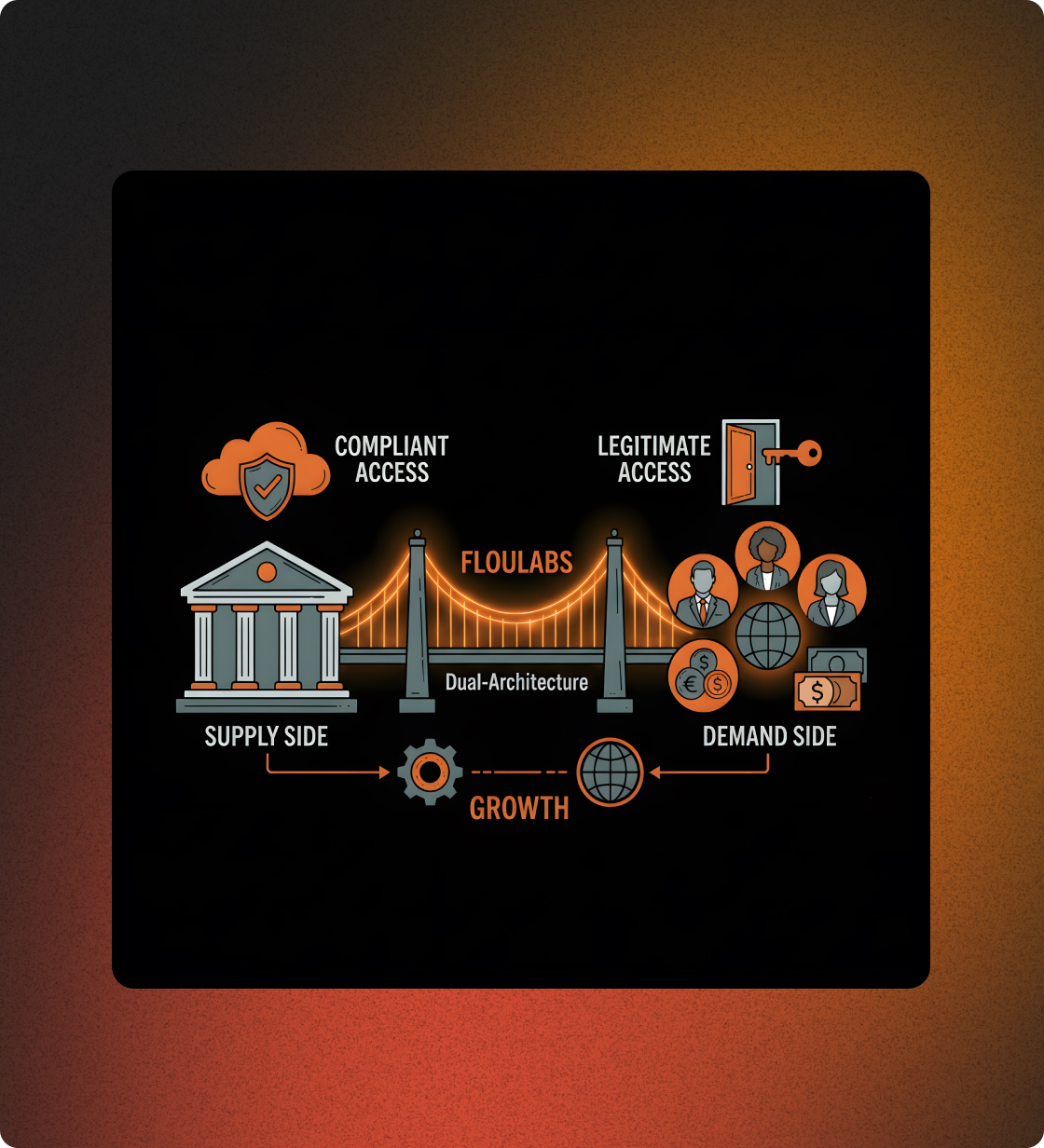

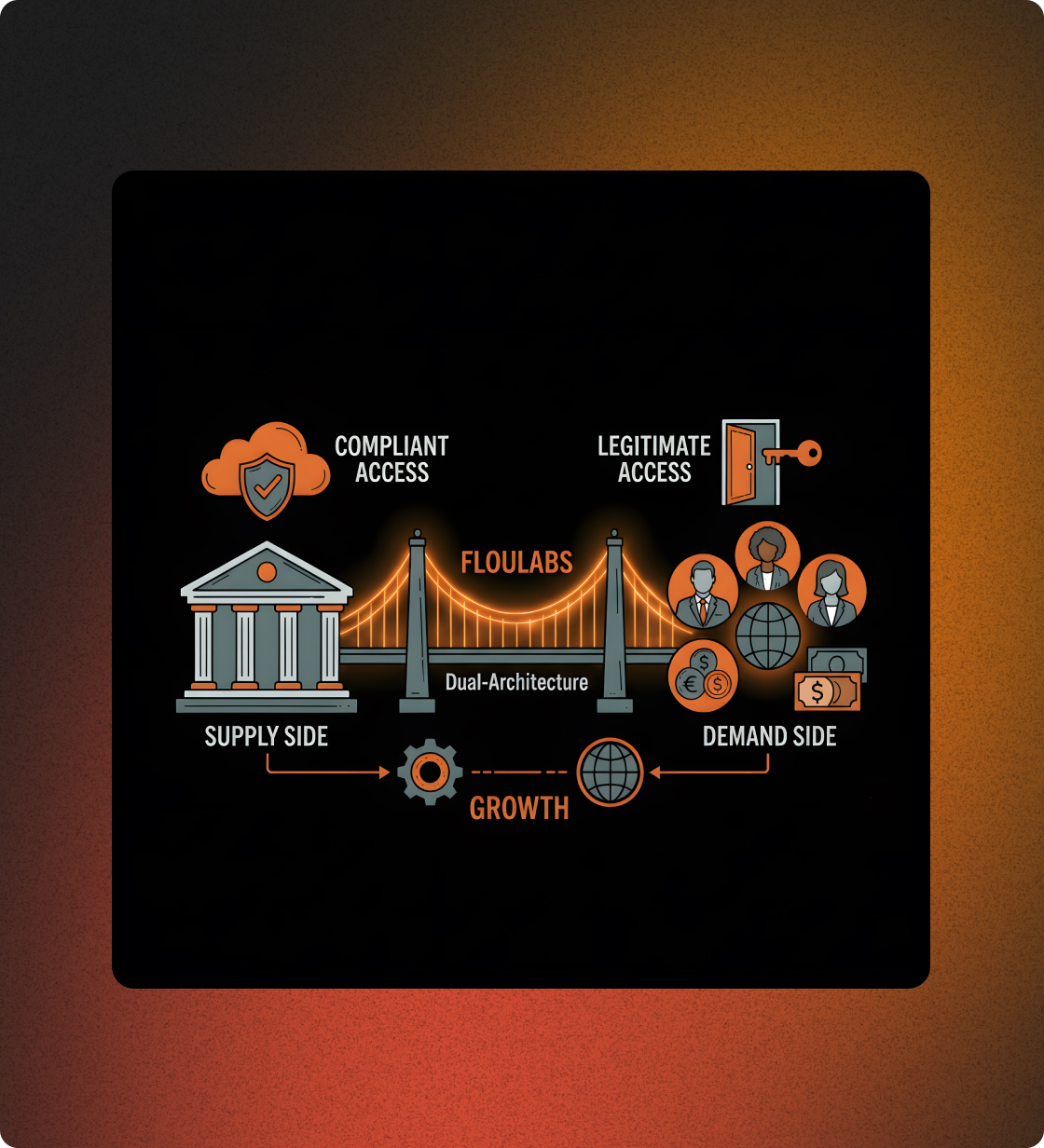

Our dual-architecture model connects both sides of the system:

Supply Side: U.S. banks gain compliant access to international deposits.

Demand Side: vetted professionals, entrepreneurs, and businesses abroad gain legitimate access to U.S. accounts and services.

The result: real growth for banks, real inclusion for users, and full transparency for regulators.

The future of balance sheet growth is not domestic competition — it’s global distribution.

FlouLabs provides a full-service infrastructure that enables banks to acquire and manage international deposits within their own regulatory framework. By handling onboarding and compliance without extra overhead, it allows institutions to scale globally with the same rigor and confidence as their domestic operations

FlouLabs acts as a specialized digital branch, enabling international deposit acquisition and account management in full regulatory alignment, without needing specialized resources or additional cost burdens. We provide the full infrastructure—customer onboarding, compliance oversight, transaction monitoring, and operational controls—within the bank’s own regulatory perimeter.

This model gives banks the ability to acquire and oversee international deposits with the same rigor they apply to domestic relationships. Every user, transaction, and program operates within one integrated compliance framework—allowing banks to scale with confidence and full regulatory alignment.

Global and regional platforms—whether payroll, trade, or service marketplaces—can now offer their users real U.S. banking capabilities through FlouLabs’ Embedded Partnership Framework.

By integrating our partner banks’ services directly into their ecosystems, platforms can help their users:

Receive and hold payments in U.S. dollars.

Simplify international transactions.

Strengthen credibility and trust with global clients.

FlouLabs manages the complexity behind the scenes—KYC/KYB verification, AML monitoring, and bank-level compliance—but our role goes further. We help platforms design or refine their solutions to meet the expectations of partner banks and regulators, leveraging our experience to ensure every program launches aligned from day one. Platforms gain new value and revenue opportunities while reducing their risk profile.

With a single integration, platforms can connect their customers to trusted U.S. financial institutions—expanding possibilities for users and deposits for banks.

A compliance-first infrastructure that connects banks, platforms, and global users—without friction.

Automated onboarding (KYC/KYB), AML monitoring, and transaction oversight that meet FFIEC and OCC standards.

API integrations that let partner banks originate, monitor, and report international accounts in real time.

Dual acquisition strategy—via partners and direct channels—creates a compliant, sustainable pipeline of new deposits.

FlouLabs operates as a specialized digital branch, executing onboarding, monitoring, and servicing under each bank’s own policies and risk appetite. We close the gap between business goals and operational execution, ensuring international portfolios are managed with the same rigor and discipline as any of their regular branches. Shared dashboards for risk visibility, reporting, and regulatory audits.

FlouLabs turns regulatory discipline into operational strength. By ensuring every account and program follows the bank’s own procedures, we reduce risk, build trust, and create a safer path for community banks to serve global customers.

Request a Partnership CallWhether you’re a bank looking to expand your reach or a platform serving global users, FlouLabs provides the infrastructure that lets you grow safely.